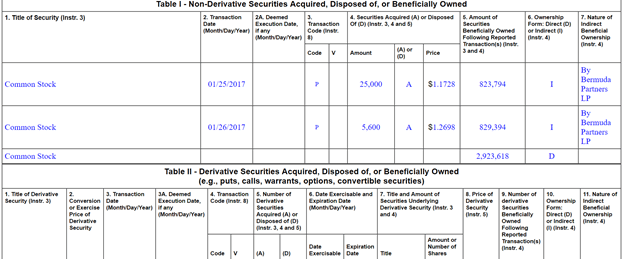

Discretionary transaction in accordance with rule 16b 3 resulting in acquisition or disposition of issuer securities. Title of derivative security instr.

conversion of exercise of derivative security meaning

conversion of exercise of derivative security meaning is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in conversion of exercise of derivative security meaning content depends on the source site. We hope you do not use it for commercial purposes.

C conversion of derivative security usually options.

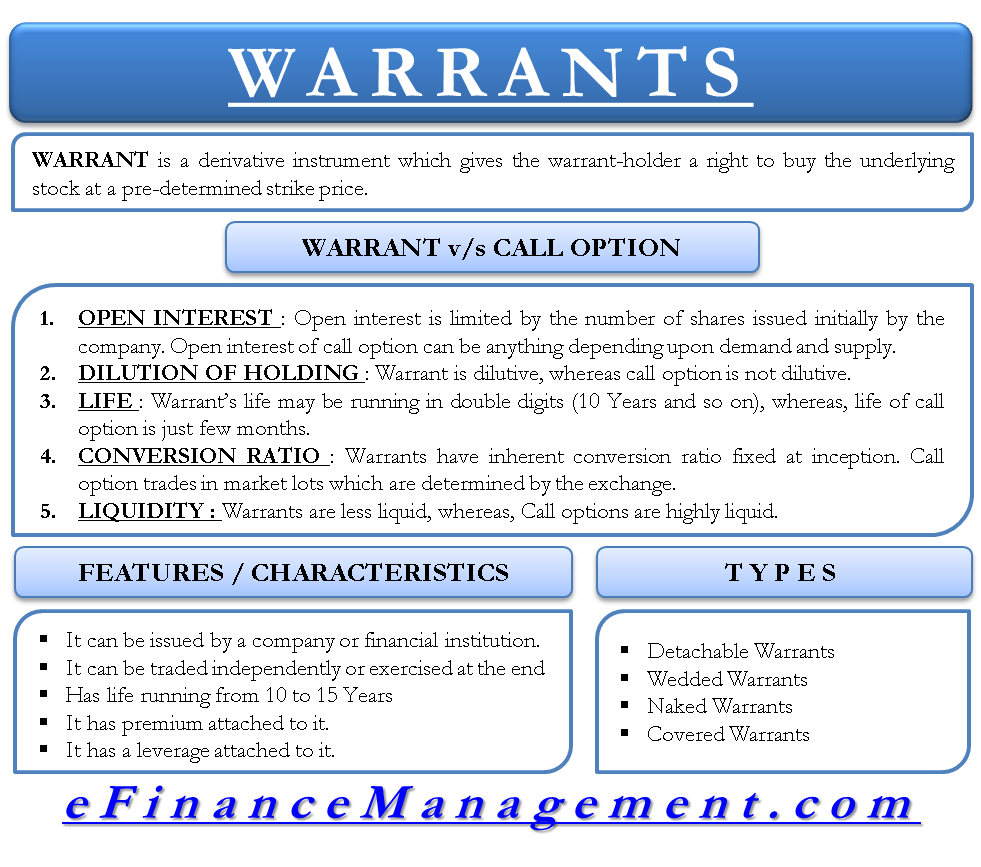

Conversion of exercise of derivative security meaning. Payment of exercise price or tax liability by delivering or withholding securities incident to the receipt exercise or vesting of a security issued in accordance with rule 16b 3. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Conversion or exercise date and the type and amount of underlying securities in the company that are covered under the derivative.

Options are derivatives while the stock for example refers to the. The conversion feature is a financial derivative instrument that is valued separately from the underlying security. A derivative is a financial instrument based on an underlying asset.

The reporting person must include the specific type of security. M exercise of conversion of derivative security. Conversion or exercise price of derivative security 3.

Derivative interest means a all of the derivative securities as defined under rule 16a 1 under the exchange act or any successor provision thereto and other derivatives or similar agreements or arrangements with an exercise or conversion privilege or a periodic or settlement payment or payments or mechanism at a price or in an amount or amounts related to any security of the company or. I discretionary transaction which is an order to the broker to execute the transaction at the best possible price. Deemed execution date if any monthdayyear 4.

Both are discretionary and have expiration dates. Exercise price is a term used in derivatives trading. M exercise or conversion of derivative security exempted pursuant to rule 16b 3 derivative securities codes except for transactions exempted pursuant to rule 16b 3 c conversion of derivative security e expiration of short derivative position h expiration or cancellation of long derivative position with value received.

In finance a warrant is a security that entitles the holder to buy the underlying stock of the issuing company at a fixed price called exercise price until the expiry date. Table ii derivative securities acquired disposed of or beneficially owned eg puts calls warrants options convertible securities 1. Therefore an embedded conversion feature adds to the overall value of the security.

Derivative securities means any option warrant convertible security stock appreciation right or similar right with an exercise or conversion privilege at a price related to an equity security or similar securities with a value derived from the value of an equity security but shall not include. F payment of exercise price or tax liability by delivering or withholding securities. Transaction date monthdayyear 3a.

Conversion Price Ratio Conversion Parity Price Significance

Conversion Price Ratio Conversion Parity Price Significance

Exercise Price Definition And Example

Exercise Price Definition And Example

Convertible Notes Are You Accounting For These Correctly Part 1

Convertible Notes Are You Accounting For These Correctly Part 1

Form 4 Filings Track Insider Money To Make Money In The Market

Form 4 Filings Track Insider Money To Make Money In The Market

Convertible Debt Definition Types How Does A Convertible Debt

Convertible Debt Definition Types How Does A Convertible Debt

Warrant Define Vs Options Features Types Efinancemanagement

Warrant Define Vs Options Features Types Efinancemanagement

Exercise Price Definition And Example

Interest Rate Derivatives A Complete Beginner S Guide

Interest Rate Derivatives A Complete Beginner S Guide

:max_bytes(150000):strip_icc()/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)